Understanding the refining and petrochemical value chains to drive optimization

Posted: August 30, 2019

Refining and Petrochemical companies face the pressure of working under tightened margins and are constantly seeking for solutions to optimize their operations and increase profitability. Several digital technologies are available to support the optimization of their value chain, but many times there is a lack of enterprise perspective, resulting in point solutions and siloed processes that leave significant values leaks.

In this post we will take a step back and analyze the value chain of a refinery or petrochemical plant, its key components, the challenges faced in each area and the interaction between them. Understanding the complexity of the value chain is critical to create a solid digitalization strategy that encompasses the entire enterprise.

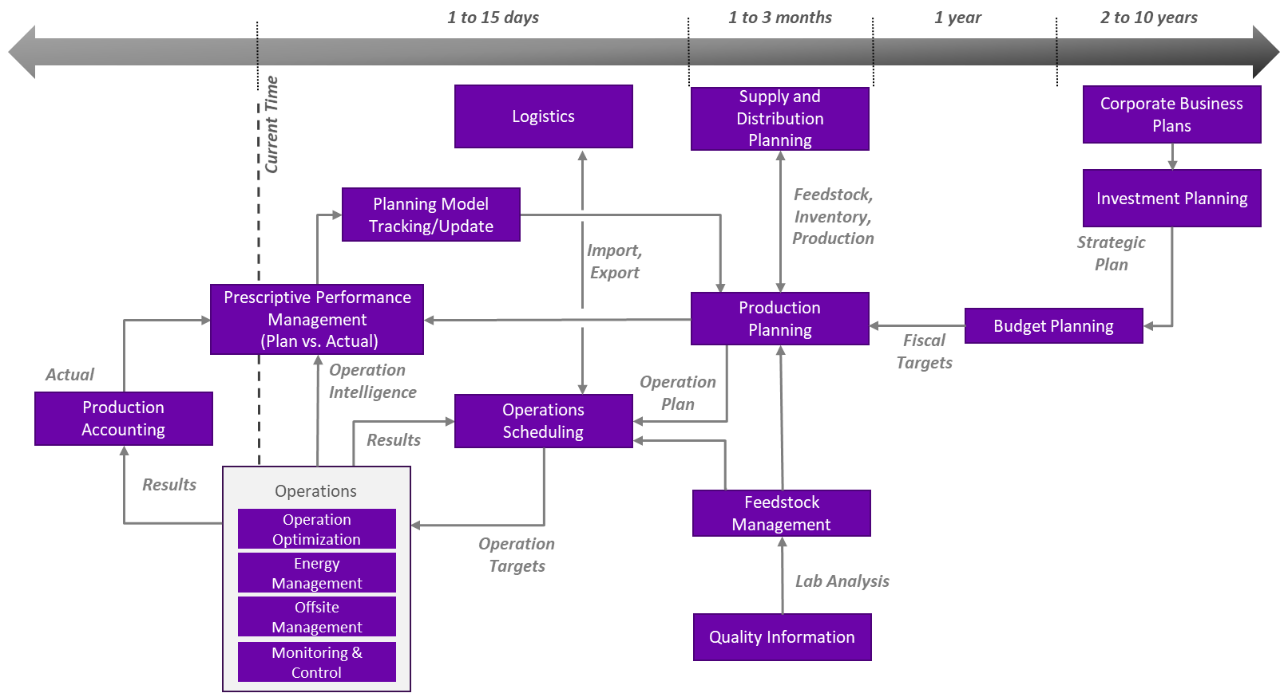

The diagram below summarizes the value chain of an oil and gas downstream company:

Corporate and investment planning helps companies decide on their long-term capital investments by analyzing different options based on supply and demand characteristics, available technology, safety and environmental requirements, and assets costs. This is a critical opportunity to add value and impact business profitability, and the challenge is that there is limited information and many uncertainties as this stage. Many companies are supported by EPC and Consultants for Master Planning studies.

For example, it is hard to predict crude oil availability and price looking in a horizon of 5-10 years. That is why the strategic planning must result in a flexible and resilient plant that is able to adapt to future market changes. With so many variables, corporate planners analyze the options knowing that the most cost-effective choice doesn’t necessarily mean the maximum return on investment.

Budget planning is executed on an annual basis, giving the supporting tools and insights to define the business fiscal targets – goals for production, sales and profit. Even though there is a smaller spectrum of choices when compared to long-term planning (since the plant is already built), there is still a considerable level of uncertainty especially on the market behavior. A good planner must rely on a trustable model of the plant as well a good set of premises and market analysis that allow solid decisions.

The next step of the oil and gas value chain enters the operational cycle, consisting of decisions that are done on a more regular basis and are constantly changing, based on the feedback of operations, feedstock quality, assets availability and fast market dynamics.

Operational planning is the first step of this short-term cycle. Decisions on feedstock purchase and monthly production plans to maximize profitability are carried out alongside assay management, feedstock quality analysis and supply and distribution planning. A key challenge relies on data consistency and accuracy, as information from different departments and teams can affect an optimal plan. Having the right information and building an agile process to quickly respond to market dynamics can bring significant margin improvement by taking advantage of economic opportunities.

Production scheduling is guided by operational planning and has the challenging responsibility to fit the plan in with reality. Daily scheduling sets the daily operational targets by analyzing the best way to meet the economic targets defined by the monthly plan, while managing a series of constant changes and operations constraints, like tank availability, fluid mismatch composition, shipment delays and unplanned maintenance. On top of which, the resulting operational targets must allow for stable and safe operations. Streamlined communication between operations and schedulers is a critical factor for a successful schedule.

The plant operations follow the targets set by the daily scheduling that is monitored and controlled by the control room and field operators. Systems for energy management, tank and movement management and product blending are often available to help operators make better decisions. Technologies like advanced process control and real-time optimization can also help the operations team to run the plant stably at the most profitable operating point. The large quantity of information available during the operation of a refinery or petrochemical plant, if not well managed, can become a challenge to operators on where to focus and on which information to trust, decreasing agility and not giving the necessary assuredness to push the operational limits.

Plant performance is measured by operations’ outputs and can be combined with planning and targets data to provide analytics and insights that can drive process improvement. More widely, all information generated through the value chain can drive additional business value when shared across different areas. For example, an updated LP model for operational planning in a plant can be used for budget planning, enabling corporate teams to create more accurate fiscal targets.

The pace of information distribution and level of data consistency through the value chain determines a company’s ability to respond to change and can hugely influence profit margins. Improving the information flow and increasing collaboration across the business is one key objective of a solid value chain optimization strategy

To better understand how value chain optimization can drive better collaboration and enable margin increases, visit AVEVA’s Value Chain Optimization page.

Related blog posts

Stay in the know: Keep up to date on the latest happenings around the industry.